A tax collected at source (TCS) is the tax paid by a seller to the government which he collects from the buyer (customer) at the time of sale. Section 206C of the Income-tax act governs the goods on which the seller has to collect tax from the purchasers.

TCS (Tax collection at source) is a tax collected additionally by a seller of specified goods from the buyer (customer) at the time of sale, is over and above the sale + GST amount and is remitted to the government account. As per ITC Act, 1961 certain people must collect a specified percentage of tax from the seller at the time of receipt of the amount from their buyers or at the time of debiting the account of the buyer whichever is the earliest.

Note: New section 206 (1H) was introduced in October 2020 for collecting TCS from the buyers, if last financial year cross Rs 10 crore turnover and cross Rs 50 lakhs in a current financial year.

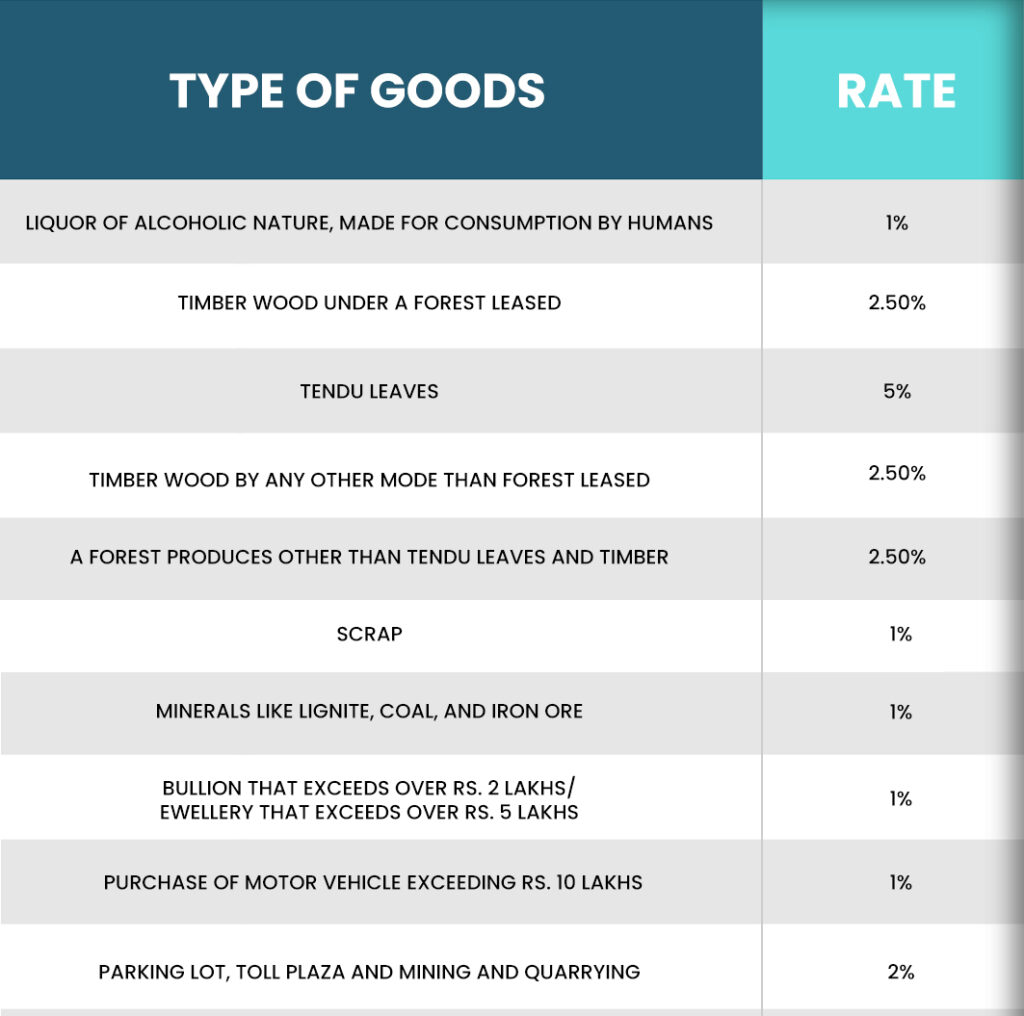

List of Goods covered under TCS and rates

Below is the list of goods covered under TCS with rates based on categories. Tax is applicable to them only when mentioned goods are used for trading purposes. If goods are used for production or manufacturing, then tax will not be applicable.

For now, NetSuite didn’t provide tax collection at the source with suitetax engine. So, we have to customize a solution that will be suitable with India suitetax engine.

For example, we are selling item A of Rs 15,000 and the GST applied here is GST 18%.

Now the calculation is as below.

Item A value: Rs 15,000

GST 12%: Rs 2,700

Total Invoice value: Rs 17,700

The invoice value or selling price is Rs 17700.00. So, the TCS is calculated on this total amount.

TCS 1% on this “Invoice Value” is Rs 177.00.

The total Invoice value is Rs 17877.00

For TCS implementation in NetSuite:

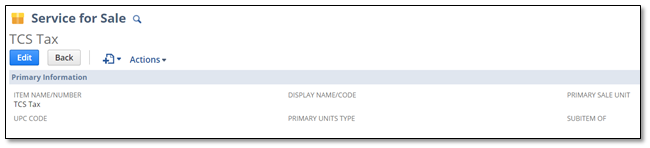

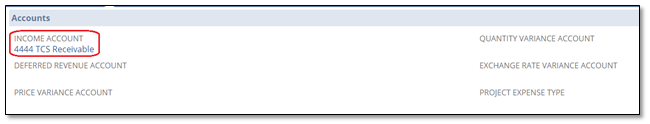

- We can create a service Item to map TCS GL and select an income account.

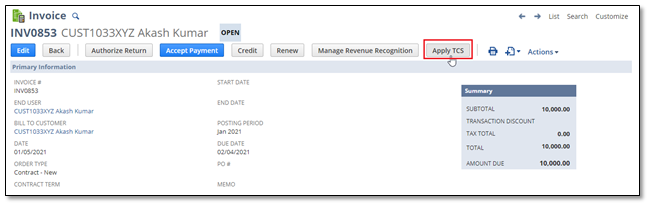

- Create a checkbox field in the invoice by the name ‘Apply TCS’, it will indicate that on this invoice TCS will be applied. Since TCS is not going to apply on all invoices so this checkbox needs to select manually by the user.

- Now for apply TCS, when the user checks the checkbox of the “Apply TCS” filed, then the “TCS TAX PERCENTAGE” filed can be filled auto for default tax percentage of TCS since the field will be editable so the user can change the tax percentage when required.

- After saving the invoice a button will appear on the invoice by the name “Apply TCS” to apply TCS on the invoice.

- We can create a workflow that will use to add a button on the saved invoice if apply TCS checkbox is checked.

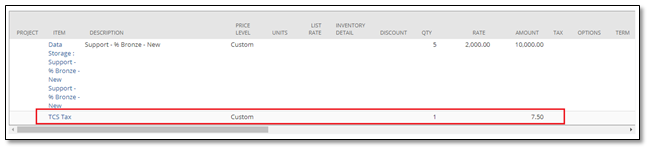

- We can create a script, which will run the calculation and set the TCS item on the invoice with the TCS amount.

- When the user clicks on the button, the workflow will run the script and add the item on the invoice with the calculated TCS tax amount.

- A filed “TCS Amount’ field can be created on the invoice which will hold the TCS amount so customers can see the TCS amount separately.

To Know more about NetSuite Cloud ERP, feel free to reach us on:

Website: http://saturotech.com/

Email ID: marketing@saturotech.com

Read More: Suite Script 2.0