Harmonized System of Nomenclature (HSN) Code is a six-digit number that classifies various products and services. Manufacturers have been using this system for years. This code is divided into 21 sections and 99 chapters and is used worldwide. The sections and chapters are referred to as “HSN” and “SAC” in global trade. The SAC Code is used to classify the products and services.

It categorizes goods for taxation, recognition, and measurement purposes. In the world of global trade, every product and service has to have a unique HSN global trade, every product and service has CODE. The World Customs Organization created the HSN to make it easier for consumers to shop for and find the products that they are looking for. In our billing software, known as BillMade users can search or generate New HSN codes for any item while billing.

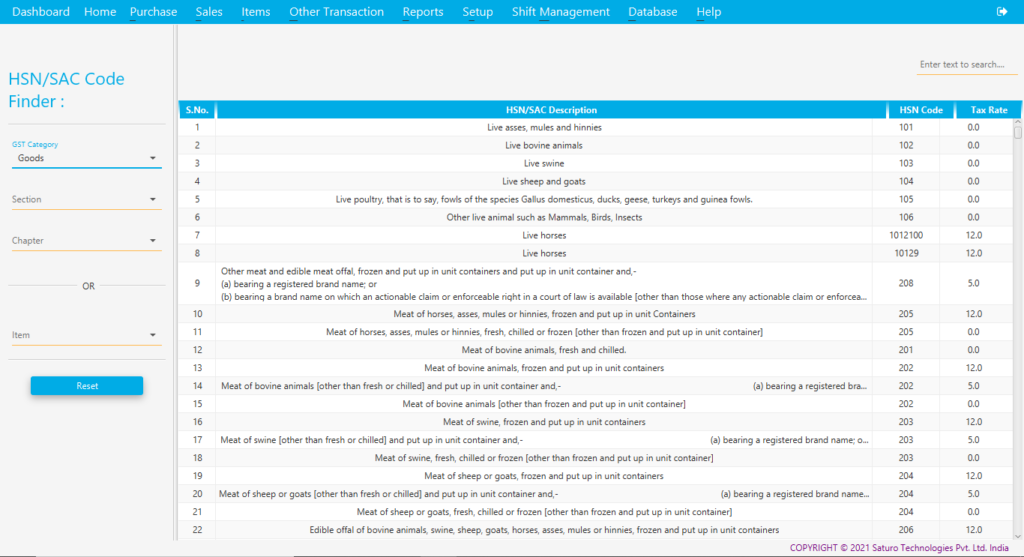

HSN/SAC CODE FINDER

In HSN/SAC finder you can find code easily with the help of a section, GST category, Chapter &Item

Enter text to search use for searching code.

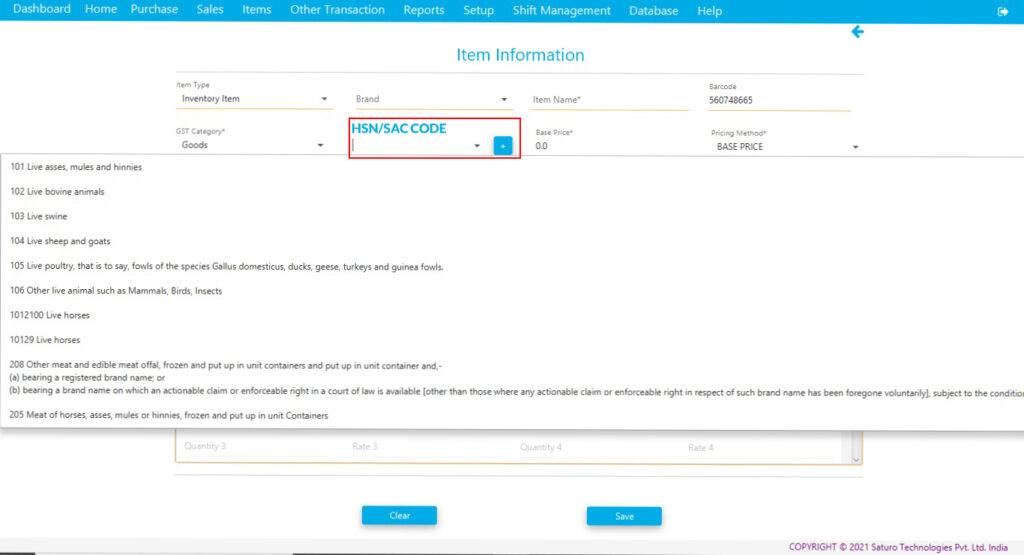

While entering the product details we can add HSN/SAC at the same time

The HSN code is composed of two levels. First, the chapter represents the highest classification level. Next, the sub-heading is the next level. For example, if the product is rice, it will be labeled as 3307 41 00. In the same way, the first two digits represent the type of rice. In the third level of sub-headings, there are different levels of classification. If a product is marketed in several countries, it will need to have an HSN code.

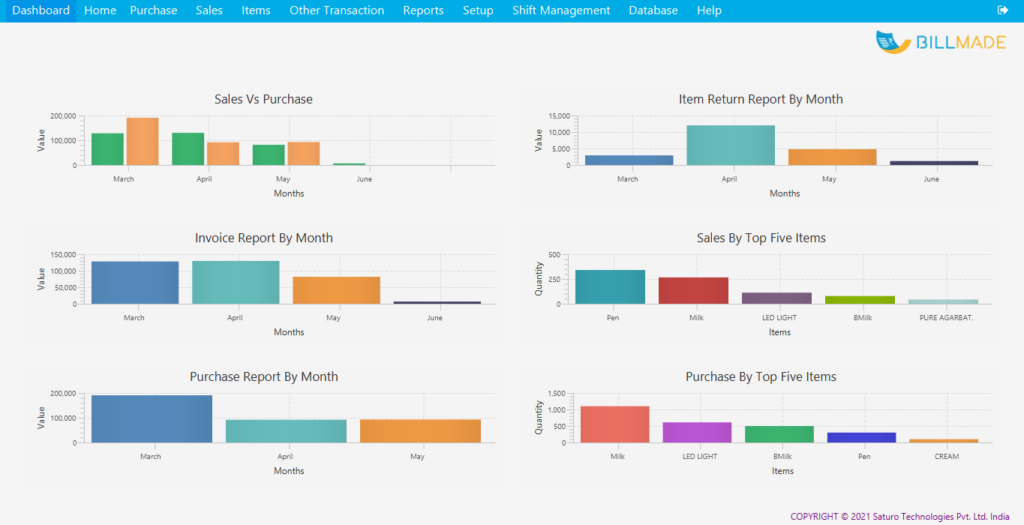

The HSN Code is the most widely used international coding system for goods and services. Developed by the World Customs Organization (WTO), the HSN codes identify products and services across the globe. In India, a separate code issued by the Central Board of Indirect Tax & Customs is used for services; billing software BillMade will help you with Inventory management Sales reports Purchase reports, etc. it is important to be aware of the tax implications of providing these services.

The HSN code is used to identify goods that are sold globally. It is a 6-digit code that can be used to reference tax data from different governments. It is also useful for companies in India to track their stock. The HSN CODE is a good way to keep track of the value of a product. The HSN CODE determines a company’s annual revenue. This information is then shared amongst all parties involved in international trade.

To Know more about BillMade POS feel free to reach us on:

BillMade Website: https://billmade.com/

Saturo Website: https://www.saturotech.com/

Email ID: marketing@saturotech.com

Buy Now: https://billmade.com/index.php/pricing-plan

BillMade Social Media Links:

- Facebook: https://www.facebook.com/Billmade-786831018169916/

- Instagram: https://www.instagram.com/billmadepos/

- LinkedIn: https://www.linkedin.com/company/billmade-pos/

- Twitter: https://twitter.com/saturotech

- YouTube: https://www.youtube.com/channel/UCdh1AYXBN3M4oBmxwGa7yeg/videos

Saturo Social Media Links:

- Facebook: https://www.facebook.com/saturotech/

- Instagram: https://www.instagram.com/saturotechnologies/

- LinkedIn: https://www.linkedin.com/company/saturo-technologies-private-limited/

- Twitter: https://twitter.com/saturotech

- YouTube: https://www.youtube.com/channel/UC69yIWnRwPV04KydM64sXTw/videos

To Read More of our NetSuite Blogs Visit: https://www.saturotech.com/blog/

To Read More of our BillMade Blogs Visit: https://billmade.com/index.php/blogs