What is Bank Reconciliation?

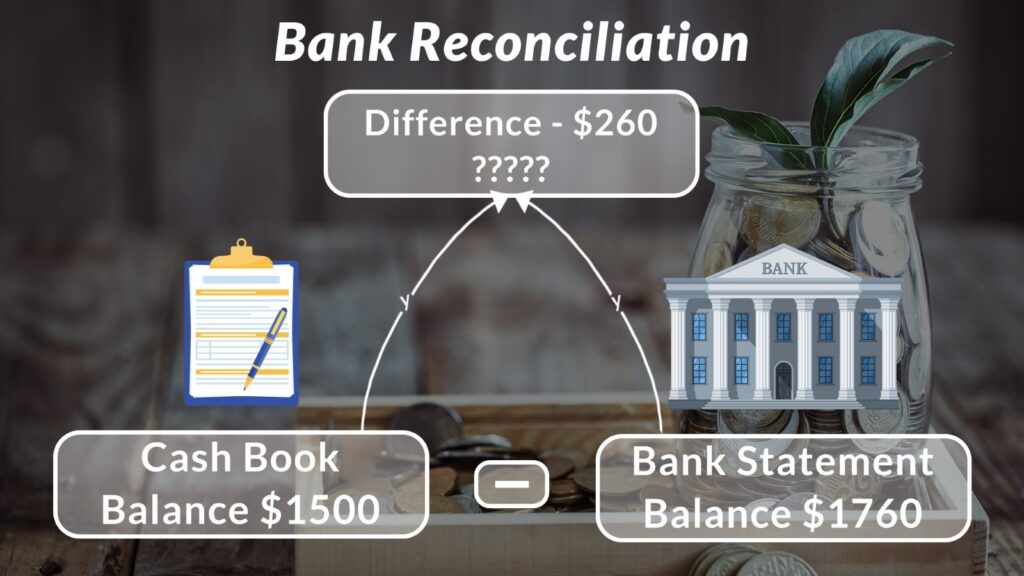

A bank reconciliation is a process of matching the balances in accounting records for a cash account to the corresponding information on a bank statement. The target of this method is to determine the variations differences between the two, as well as to book changes to the accounting records as appropriate.

The reconciliation statement helps discover the differences between the bank balance and book balance.

Advantages

- It makes accounts to be in good position.

- It will put a stop to theft.

- It will keep mistakes at control.

- It helps you determine accounting errors.

- It will give accurate balance.

Bank Reconciliation in NetSuite

- Reconcile your bank statement against your bank account register to keep your NetSuite account accurate.

- New transactions can be enter while reconciling.

- Bank Reconciliation can do in two ways:

- Bank Reconciliation Generate Manually.

- Bank Reconciliation Generate using Imports.

Generating Bank Reconciliation by Import

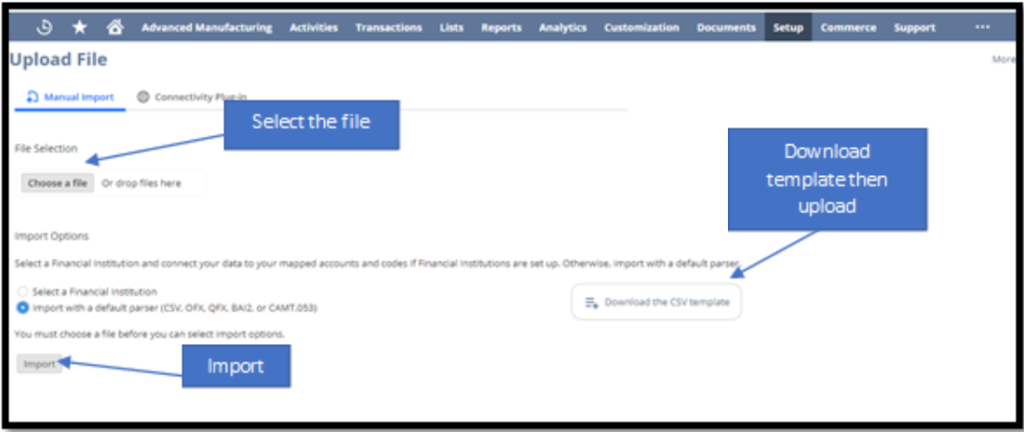

You can download a bank or credit card statement file from your financial institution and then import it into NetSuite for reconciliation. NetSuite encodes financial data files during processing. Files are removed and not stored after processing.

Reasons for manual import include the following:

- You have a small volume of data that you have already downloaded from a bank and have on your local machine.

- You want to upload a single file

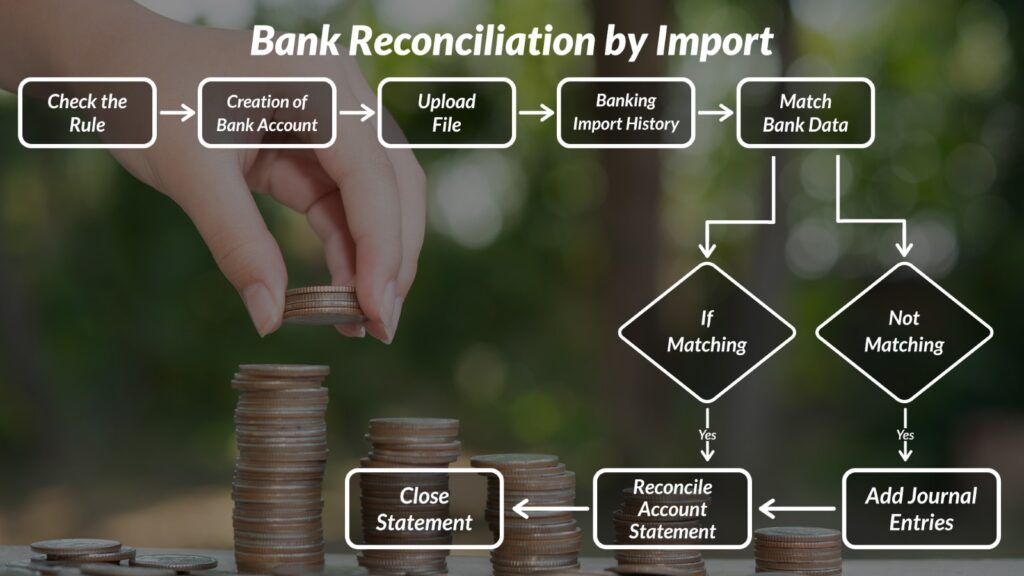

Steps of Bank Reconciliation in NetSuite

1-Check the rules – Navigation-Transaction>Bank>Reconciliation Rule.

NetSuite includes system transaction matching rules to automatically match imported transactions with existing account transactions in NetSuite. These default matching rules run on all transactions.

2- Create your bank account- Navigation-Setup>Accounting>chart Of Accounts> New.

This can be done by creating or editing the existing bank account. Check the box use match bank data and reconcile account statement pages.

3– Import of bank data- Navigation -Transactions > Bank > Bank Import History > Upload File.

4- Banking Import history- Navigation -Transactions > Bank > Bank Import History.

This step is for the check of import of data successfully completed or failed.

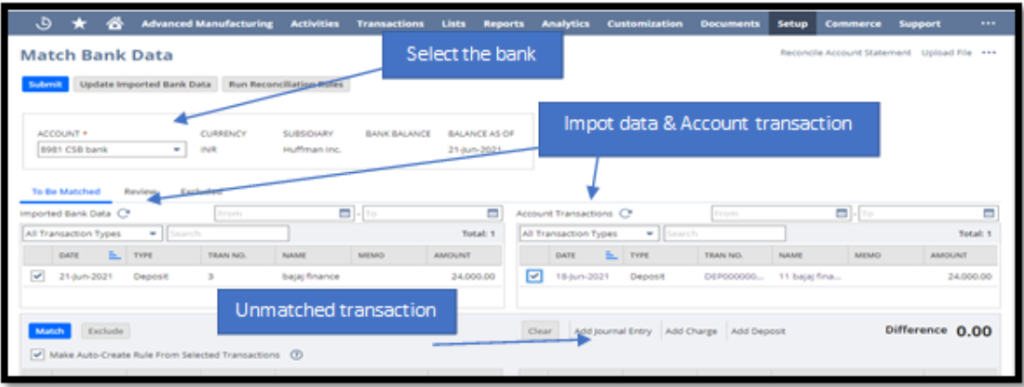

5-Match bank data- Navigation-Transactions > Bank > Match Bank Data.

When bank data is imported into NetSuite, the intelligent transaction matching feature attempts to match the imported bank lines with the existing account transactions in NetSuite.

6- To adjust the account- Navigation-Transactions > Financial > Make Journal Entries

If data are not matching you can create journal entries also to adjust. Journal entries should be approved. Your journal entries will be shown in match bank data. On the right side of the account transaction.

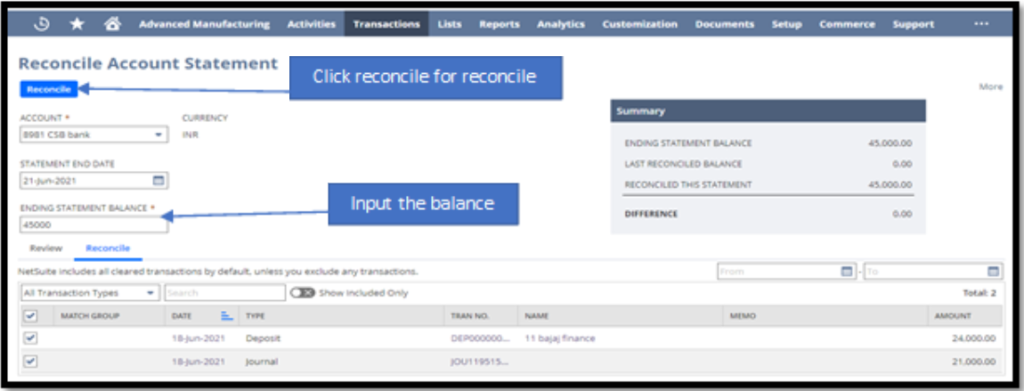

7-Close statement- After Submit of Bank, Data Click Reconcile the Account Statement.

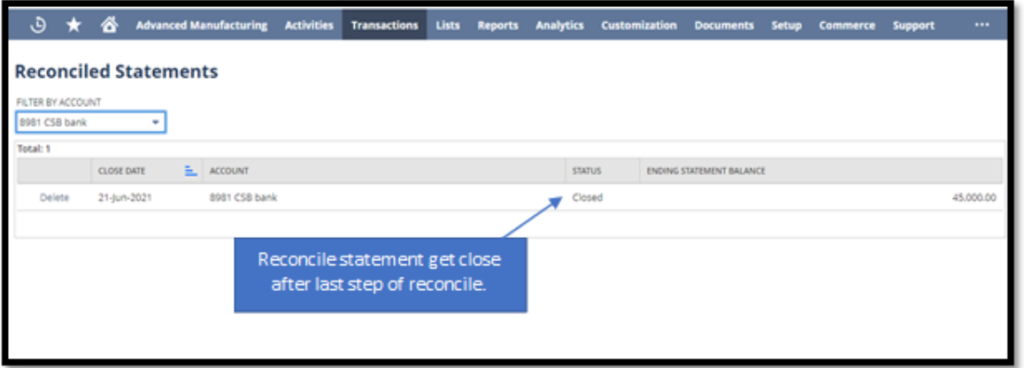

8- Closing page- Reconcile statement get close after the last step of reconciling.

The status will be closed when you have accurately reconciled the statements. This is the end step of the reconciliation process.

This process of Import of data by using NetSuite will help to a reconciliation of bank for more than one transaction at one go.

To Know more about NetSuite Cloud ERP, feel free to reach us on:

Website: https://saturotech.com/

Email ID:sales@saturotech.com

Contact No: +91 844-844-8939 (& Press 3)

You may also be interested in reading this:

How to handle Tax Collection at Source (TCS) in NetSuite

NetSuite for Manufacturing Business Processes