Fixed Assets

Fixed assets are long-term, touchable assets that are utilized in a company’s activities. They have been providing financial assistance for more than a year. Within a year, the fixed assets are not scheduled to be consumed or converted into income.

Utilization of Fixed Asset

Any company’s fixed assets are crucial. Apart from being used to help business logic generate revenue, they are closely looked at by investors to decide whether to invest in the company. The fixed assets are used to determine the efficiency of the fixed assets.

Differences Between Assets and fixed assets

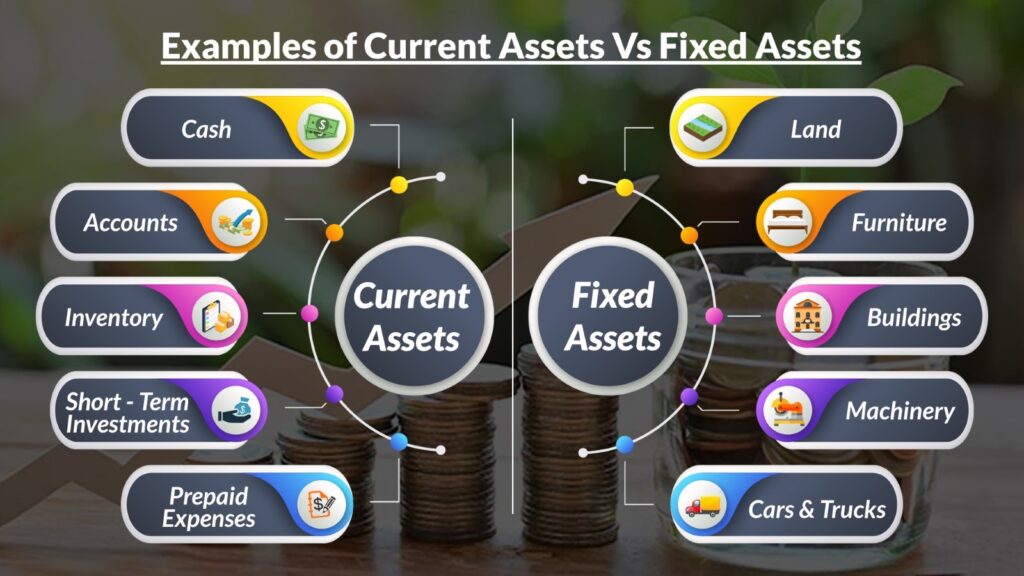

- Assets and fixed assets cannot be distinguished since they are comparable in many respects, but they can be distinguished in terms of how they are used and how they affect the transaction.

- Assets are the resources of any organization which is responsible for any kind of transaction. Some of the examples of assets are cash, accounts receivable, inventory, etc.

- Fixed assets are the long-term tangible assets that are used in business, like property, plants, or equipment. Some of the examples of fixed assets are land, buildings, manufacturing equipment, office equipment, etc..

Type:

- Tangible Assets: Assets are real things. These include structures, land, hardware, equipment, and furnishings, among other things.

- Intangible Assets: Assets are everything that doesn’t have a physical existence. This involves things like goodwill, licensing, registered or registered logos, and so on.

Fixed Assets Management Overview

- NetSuite Fixed Assets Create a working environment asset management procedure such as asset acquisition, depreciation, and maintenance schedules.

- You should use NetSuite Account to track asset depreciation both new and mid-life assets. Purchases and expenses can also be used to establish new asset records.

How to create and edit asset records:

- Updating FAM Records: If you’re updating the Asset report it’s going to have an effect on the original cost, depreciation start date, or cumulative depreciation, then you may also need to update the original asset history records.

- Creating Asset: To create asset records: Go to Fixed Assets > Transaction > Asset Creation.

How to control depreciation:

- Depreciation of Assets: An Asset Depreciation can be run to depreciate belongings for the primary time or to depreciate an asset of depreciation approach or period.

- Fixed Assets > Transactions > Asset Depreciation

- Asset Disposal: There are two ways to dispose an Asset: Sale or Write Off. When a set asset is disposed of both for the duration of or on the stop of its beneficial financial life, an adjustment desires to be made to the depreciation provision account in order that the account stability represents handiest the collected depreciation thus far on constant belongings held at that factor in time.

- Revaluation of an Asset: Revaluation is a technique that adjusts the proper fee of the constant property owned. Asset Revaluation is supported for accounting strategies only. In times wherein the Net Book Value of the asset increased, a poor quantity can be entered at the Write down Amount field.

- Fixed Assets > Transactions > Asset Revaluation.

- Asset Transfer: You can switch Fixed belongings in NetSuite among exceptional subsidiaries or departments or among locations, etc. You can procedure an asset switch for a single asset or for more than one belonging. Please follow the below steps to both switch a single asset or more than one belonging.

- Fixed Assets –> Transactions –> Asset Transfer

FAM

1. Create Assets From Transactions

2. Create Direct Assets

3. Depreciate Assets

4. Update Assets in Mid Life

5. Import Mind Life Assets

- Create Assets From Transaction

- Asset Creation : Used for each period of asset creation.

- Asset Proposal and Generation :The purpose of Multiple Asset Proposal is to keep track of the asset creation process. go to Fixed Assets > Background Processing > Status.

- Create Direct Assets:

- The Asset Creation feature in the FAM enables you to automatically create assets without the need to propose them first.

- To create asset records

- Go to Fixed Assets > Transaction > Asset Creation.

- Deprecation of assets

- To depreciate assets for the period

- Go to Fixed Assets > Transactions > Asset Depreciation.

- Fixed Assets Management Asset Depreciation

How to create asset history in NetSuite

This Assets History record is not creating any GL impact it uses only for Reporting Purposes only. For creating assets history records 2 ways

- Manually

- via CSV Import.

Fixed Assets’ Significance

- You would be able to acquire reliable financial reporting and financial analysis if you have information about an organization’s assets.

- These reports are used by a business to track, depreciate, and dispose of assets.

- Financial experts utilize data on fixed assets and their depreciation to determine if a company is profitable or not

To Know more about NetSuite Cloud ERP, feel free to reach us on:

Website: https://saturotech.com/

Email ID:sales@saturotech.com

Contact No: +91 844-844-8939 (& Press 3)

You may also be interested in reading this:

How to handle Tax Collection at Source (TCS) in NetSuite

NetSuite for Manufacturing Business Processes

Understanding SUITELET 2. x Basics

Bank Reconciliation In NetSuite By Import