Posting Vendor bill variance is used to reconcile the variance amount of, item receipt and vendor bill.

If you want to procure the items from the vendor in NetSuite we will enter purchase orders, Item receipts, and vendor bills, each transaction can show a quantity, price, and exchange rate for the items.

While entering purchase-related transactions in NetSuite If there is any difference between the quantity and price a remaining value may post to the Accrued Purchases account. If you have enabled the Advanced Receiving feature in NetSuite, you can use the vendor bill variances process to generate journal postings to variance accounts based on the differences.

Please find below an example of the process in NetSuite to reconcile the variances using the Post Vendor Bill variances page.

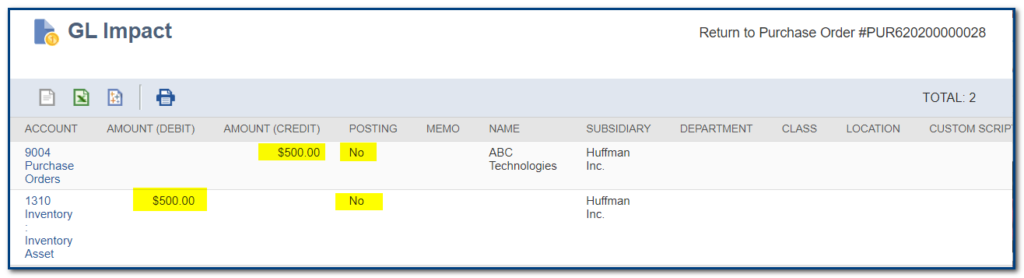

Step1: Create Purchase Order with Item Quantity = 10 and Item Rate = $50.00

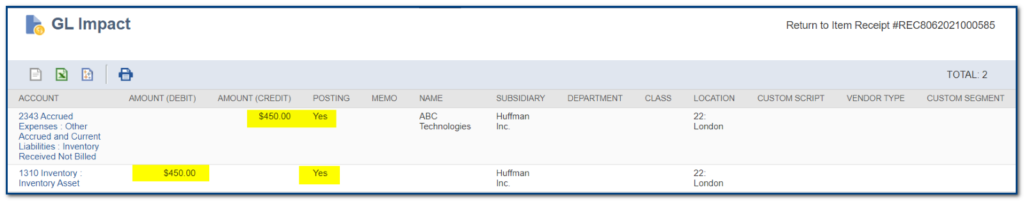

Step 2: Create Item Receipt with Item Quantity = 10 and Item Rate = $45.00

The amount on the item receipt shows (10*45) $450. This amount is inventory received not billed.

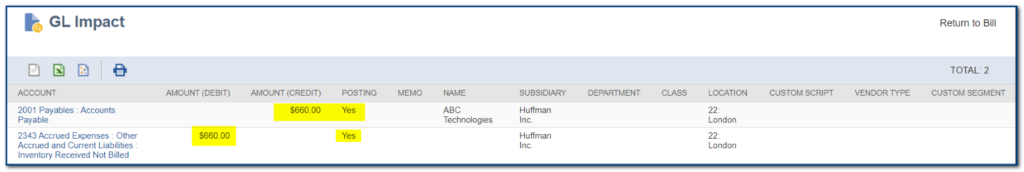

Step 3: Create vendor bill with Item Quantity = 12 and Item Rate = $55.00

The amount on the vendor bill shows (12*55) $660. This amount is accounts payable.

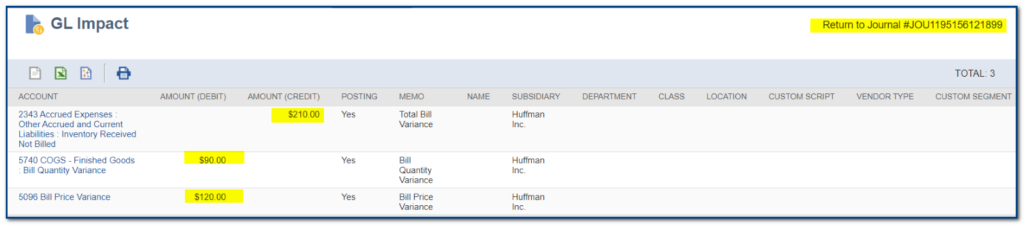

Above transactions, the amounts on the item receipt and vendor bill do not match, the remaining amount ($660 – $450 = $210) needs to be reconciled. To resolve these types of differences, In NetSuite, we will create post variance journal entries using the Post Vendor Bill Variances page.

Posting Vendor Bill Variances:

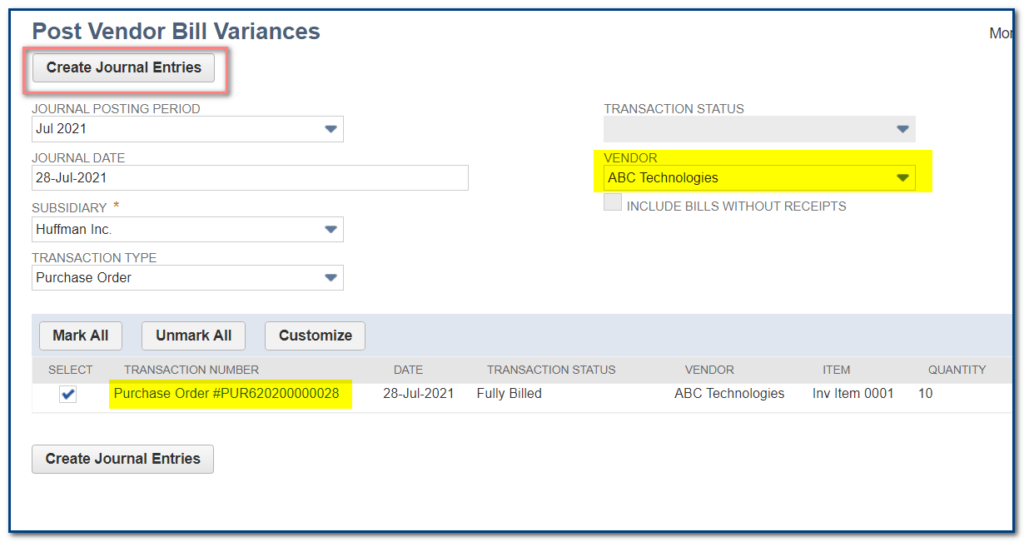

Navigation: Go to Transactions >> Payables >> Post Vendor bill Variance.

- Select the posting period for the Journal entry.

- Enter the date of the Journal entry.

- Select subsidiary If you use NetSuite one world account,

- Once you select the vendor, the list shows only transactions associated with the selected vendor.

- You can select transaction status only for bills.

Once you select the transaction and click create journal entries button the difference amount is reconciled. Find below Journal Entry GL impact Screenshot.

To Know more about NetSuite Cloud ERP, feel free to reach us on:

Website: https://saturotech.com/

Email ID:sales@saturotech.com

Contact No: +91 844-844-8939 (& Press 3)

You may also be interested in reading this:

How to handle Tax Collection at Source (TCS) in NetSuite

NetSuite for Manufacturing Business Processes

Understanding SUITELET 2. x Basics

Bank Reconciliation In NetSuite By Import

Vendor Prepayments in NetSuite

Netsuite SuiteScript 2. x – Scheduled Script